Secure Data Recovery Blog

Welcome to our blog! Here, we explore many topics related to data recovery and digital security. We aim to provide guidance and valuable insights for people at all skill levels. We offer an in-depth guide to data recovery, including step-by-step instructions for restoring lost or corrupted data, an explanation of the common causes of data loss, and effective strategies to prevent future issues. Join us to stay up-to-date on the latest trends and technologies in the field.

Monolithic Flash Drive Recovery

Pinpointing the cause of data loss and then restoring lost files is often a complex process. That is especially true for mode...

Posted by T.J. Burlee December 16, 2025

Corrupted SD Card Recovery for Woods Hole Researchers

For nearly a century, the Woods Hole Oceanographic Institution (WHOI) has been at the forefront of marine research. From deep...

Posted by Monica J. White November 21, 2025

SD Card Recovery in NYC Restores Priceless Photos

Few artists capture the soul of New York City quite like Joseph DiGiovanna. A cinematographer, photographer, and composer, Jo...

Posted by Monica J. White November 14, 2025

How to Dispose of Hard Drives

Destroying old hard drives has never been more essential given the value of sensitive data. IBM estimates that the global ave...

Posted by T.J. Burlee October 30, 2025

Best External Drives

External storage remains valuable as the global volume of stored data continues to grow. Even with cloud services, these devi...

Posted by T.J. Burlee October 21, 2025

How To Fix iPhone Unavailable

The iPhone Unavailable error is a frustrating scenario that occurs when the device becomes locked. In most cases, the iPhone ...

Posted by T.J. Burlee October 17, 2025

iPhone Is Working but the Screen Is Black? How to Fix

An iPhone screen going black while the device is otherwise working is a frustrating experience. You might still hear notifica...

Posted by T.J. Burlee October 17, 2025

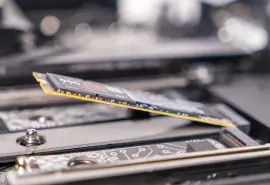

Best SSDs 2025: Gaming, Video Editing, PCs, and Laptops

Solid-state drives (SSDs) have become the dominant device for desktops and laptops as NAND flash storage continues to evolve....

Posted by T.J. Burlee September 22, 2025

Ultimate Photo Recovery Guide: How To Restore Pictures

Smartphones and digital cameras have made taking photos easier than ever. According to Photutorial, humans take over 5 billio...

Posted by T.J. Burlee September 16, 2025

How To Fix an External Hard Drive Not Showing Up on Windows

External hard drives are often a convenient, secure method of storing data or transferring files between devices. However, ex...

Posted by T.J. Burlee September 15, 2025

External Hard Drive Not Showing Up on Mac

Millions of Mac users depend on external hard drives for extra storage space and file transfers between computers. That cruci...

Posted by T.J. Burlee September 15, 2025

How We Recovered Data From Multiple RAID 5 for DENSO

DENSO is one of the largest auto parts suppliers in the world. Established globally in 1949, the Fortune 500 company designs ...

Posted by T.J. Burlee September 09, 2025

How To Fix Mac Not Recognizing WD External Hard Drive

Few issues are more frustrating than plugging in your Western Digital external hard drive only to find your Mac doesn’t recog...

Posted by Zane Kennedy September 02, 2025

What Is a U.2 SSD and How Does It Work?

Solid-state drives (SSDs) have changed the way we think about storage. They’re faster, smaller, and more reliable. But as SSD...

Posted by Monica J. White August 22, 2025

Windows 11 Update Could Corrupt Files

On August 12, 2025, Microsoft released a cumulative update for Windows 11 systems to address security concerns. The update, i...

Posted by T.J. Burlee August 19, 2025